Buy Here—Pay Here: The Carnival Game of Buying a Used Vehicle

Buy here—pay here “’is not the car business. This is the finance business,’ said Ken Shilson, an accountant who founded the National Alliance of Buy Here Pay Here Dealers in Houston. ‘Not everybody has the stomach for it.’” These words are true. And they should sound a warning bell.

Private equity firms are investing in chains of used-car lots, and auto loans are being packaged into securities much like subprime mortgages. They’re attracted by the industry’s average profit of 38% for each car sold.

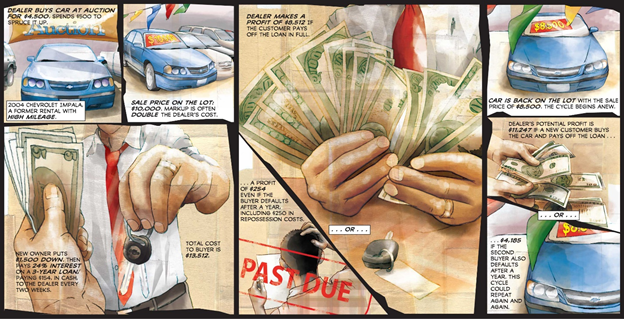

Buy here—pay here is also a wheel that rolls over many consumers. The graphic below taken from a L.A. Times article lays out the cycle:

The first thing to note is that the price you pay for a vehicle at a buy here/pay here lot is usually much greater than the blue book or NADA value of the vehicle. Indeed, you have probably noticed that most buy here/pay here lots do not advertise the price of the vehicles on their lot. This is because these dealers sell a payment not a vehicle. That is, the dealer finds out what you can pay on a weekly, bi-weekly, or monthly basis and steers you to vehicles that fall within those payment parameters.

The next thing to note is the interest rate. It will be much higher than you would pay if you purchased a car with a bank loan or with traditional financing. This again is byproduct of selling a payment rather than a vehicle.

The final thing to note is the wheel turning and crushing you. At the first opportunity, a buy here/pay here dealer will repossess the vehicle and sue you for the deficiency balance. As explained by the L.A. Times:

A key reason for the industry’s growth in tough times is that dealers can come out ahead whether or not customers keep up with their loan payments.

About 1 in 4 buyers default. In the real estate and credit card industries, that would be bad news. In the world of Buy Here Pay Here, it’s just another avenue for profit: The car can be repossessed and put back on the lot for sale in short order. A new buyer makes a down payment, takes on a high-interest loan and the cycle starts anew.

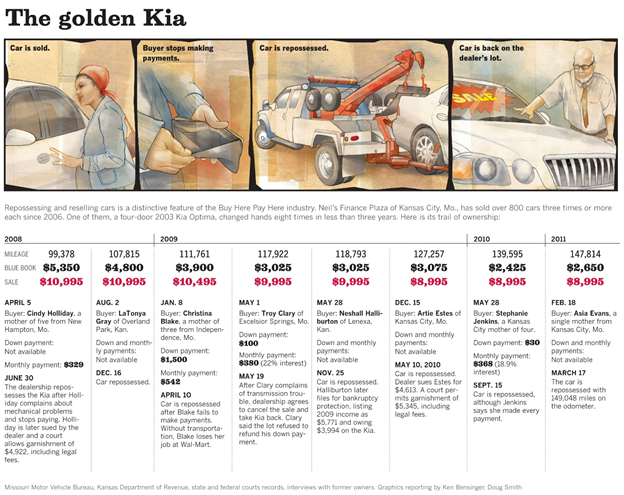

Provided they don’t get wrecked, these recycled vehicles just keep paying dividends. At some dealerships, cars have been sold and resold over and over — three, four, even eight times apiece, motor vehicle records show.

And of course, when it sues to collect the deficiency balance on the defaulted loan, the dealer can get a judgment against you, which is a super debt that allows the dealer to garnish your wages and bank account. That is, you’re stuck paying for a car you no longer have. When you default on your car loan, the dealer profits.

If a buy here/pay here dealer has sued you to collect a deficiency balance due on your vehicle loan, please call or email me today. We may be able to help.